🧵 View Thread

🧵 Thread (12 tweets)

1/ The allocation for reddit’s power users is so cool. I hope ppl realize it’s a gift, bc usually those are fought over by insiders like the bank’s favored clients or institutional investors. Reddit is giving away a free option, and that has real value.

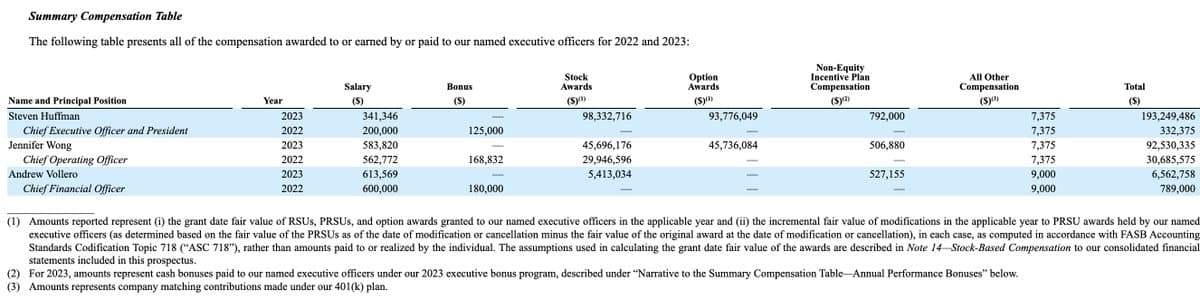

2/ I’ve seen ppl claiming CEO comp was $193M in 2023. First of all, everyone saying “gee that’s why Reddit isn’t profitable” should look again bc the cash comp is ~$1M salary and bonus. But even more importantly… https://t.co/fY3e6SjKf7

2 cont/ Careful readers will notice a footnote, referring you to the Executive and Director comp section … which says the grants vest over ~10 years. So that turns $192M equity comp into ~$19.2M per year. To miss something this basic is … well, it’s embarrassing. https://t.co/2ErfycAh70

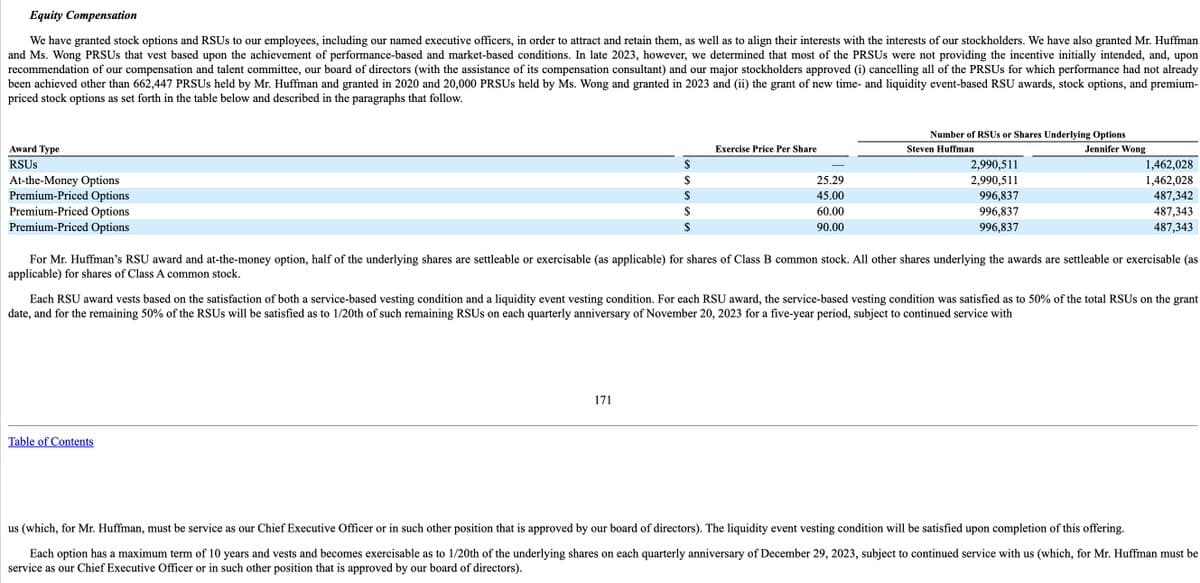

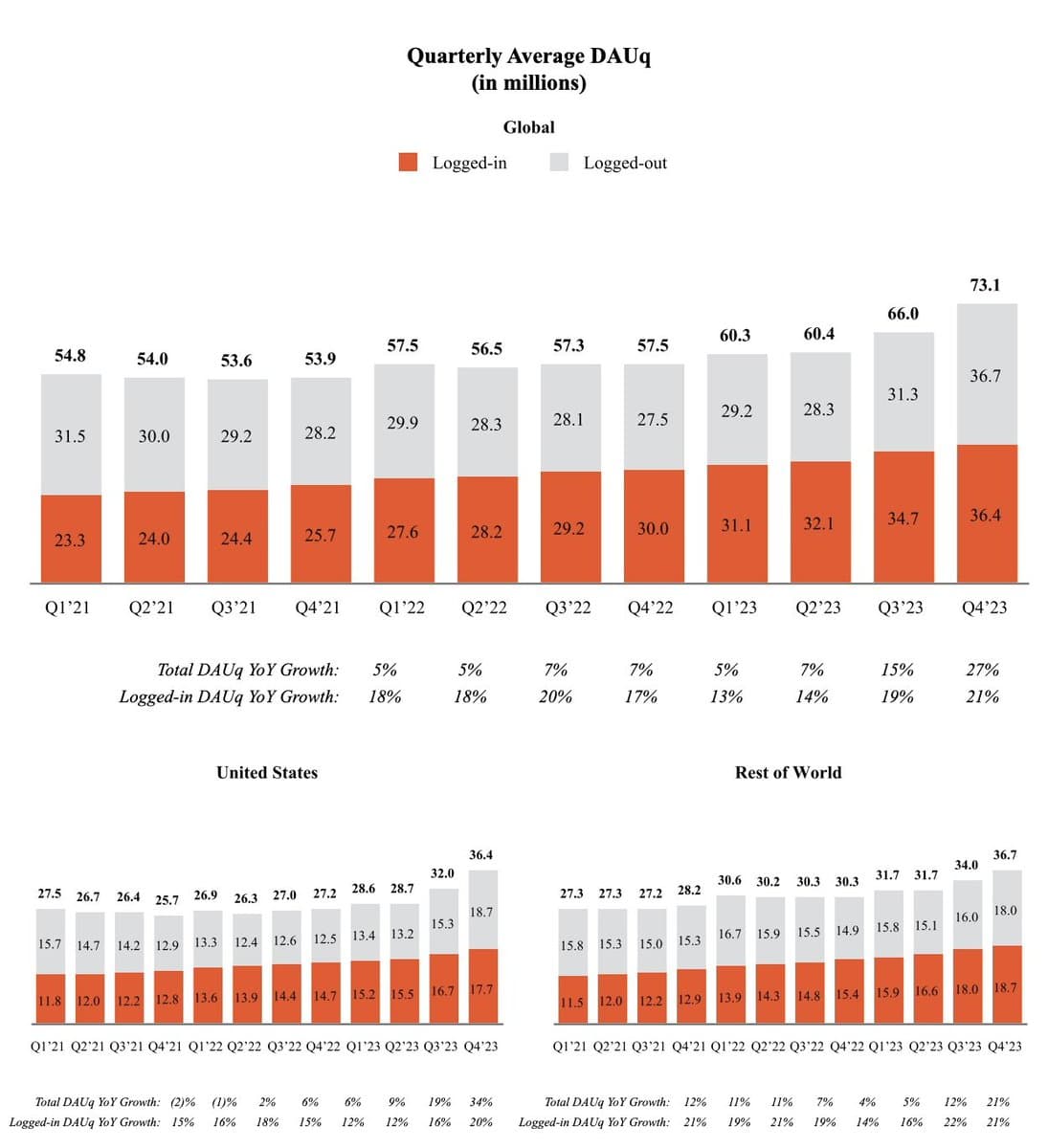

3/ Everyone is focused on revenue and profit, but for social media what really matters is daily uniques (DAUq in the S-1). On page 97 we finally get to the good stuff. The short version: consistent +20% YOY growth. At reddit’s size, that’s very strong. https://t.co/rehn99hR7m

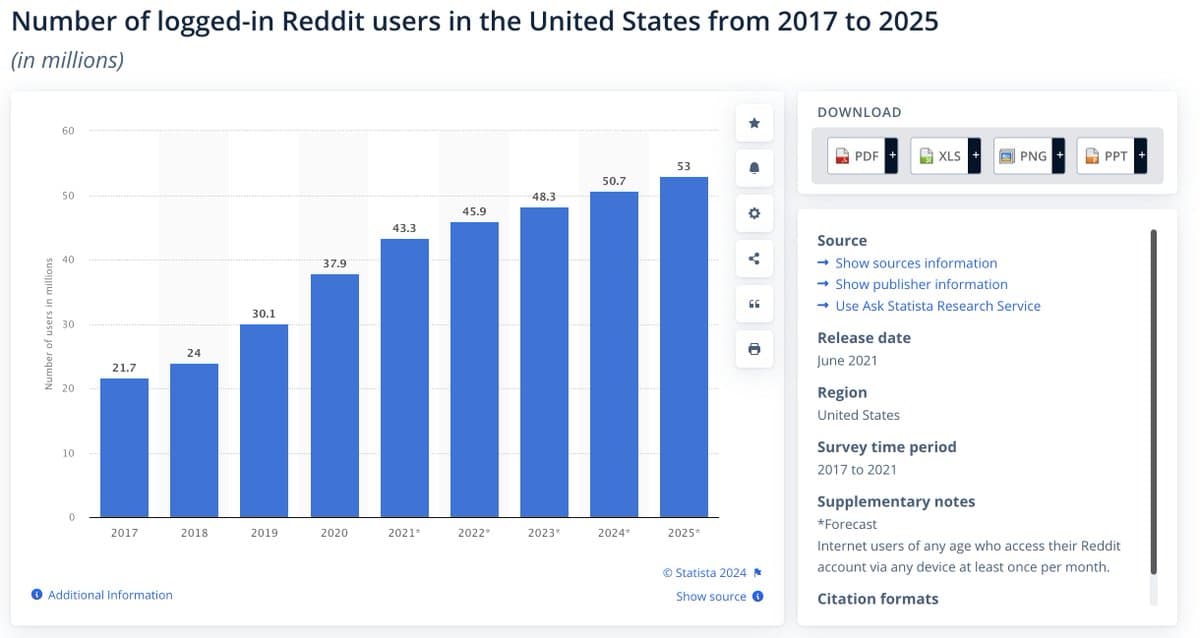

4/ There’s a dip in DAUq growth from early 21 to late 22…if I had to guess, this is the hangover from Reddit’s rapid growth during the COVID lockdowns. That growth was partially due to pulling forward growth that would have happened a year later. (chart from Statista not S-1) https://t.co/JrwBAJTjHU

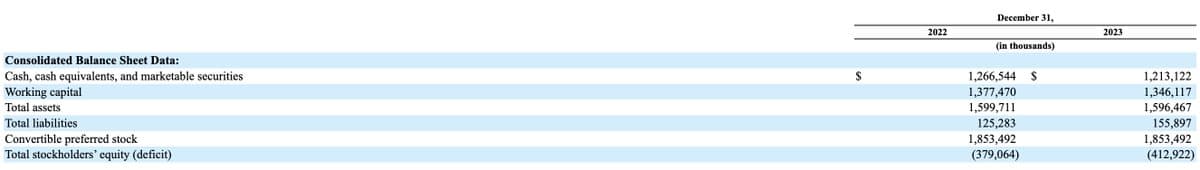

5/ Reddit is sitting on a warchest of like $1.2 billion in cash, burned just $75m in cash 2023 and dropping from there… They’re definitely not raising this money bc they need cash. Probably just to create liquidity for shareholders and employees. https://t.co/N941BI7mMf

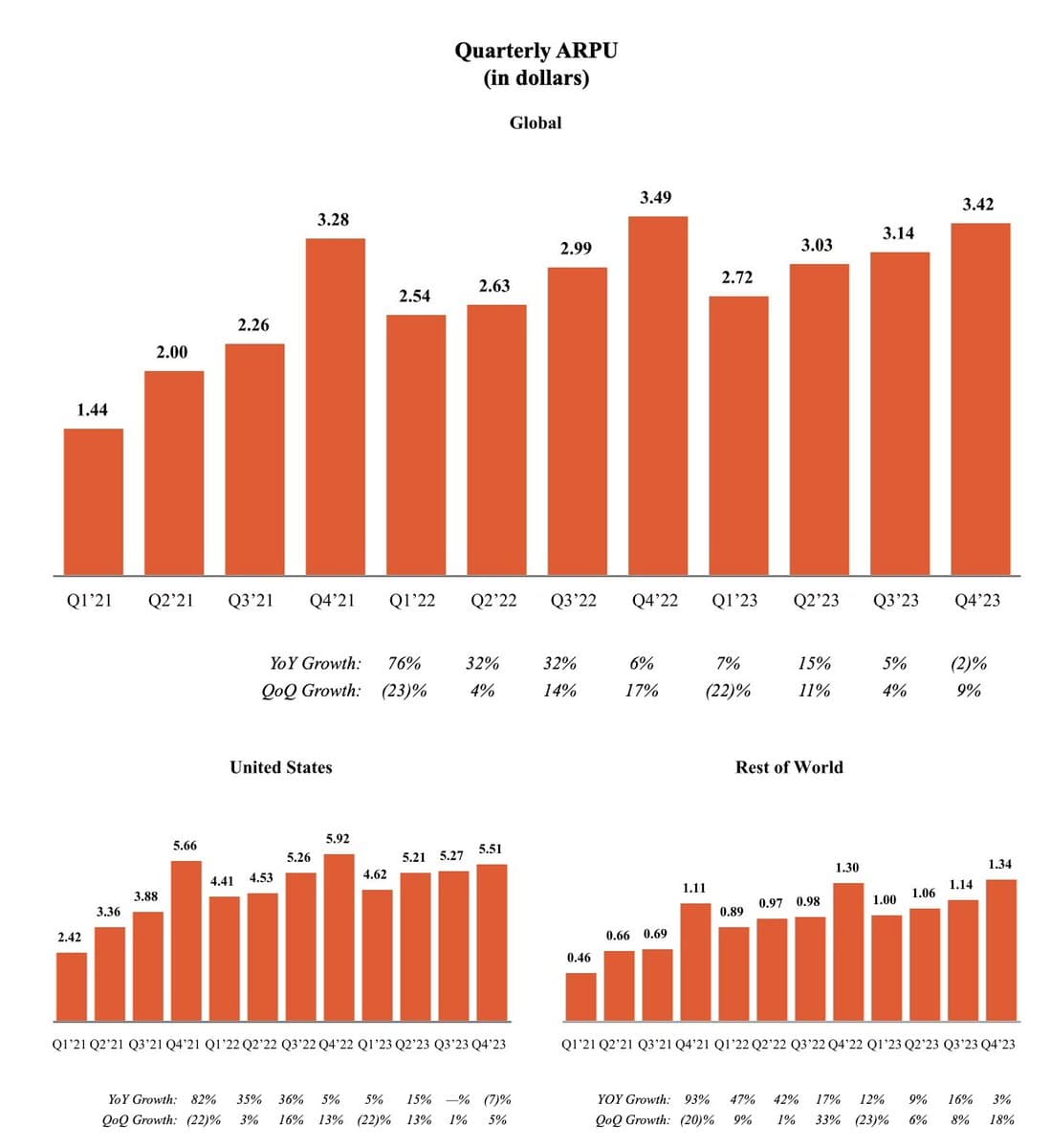

6/ ARPU improvement is quite impressive. It’s usually easy to sell out in Q4, so the real test of your ad product is how it does the rest of the year where the results speak for themselves. Increasing ARPU while increasing DAUq is hard! https://t.co/SBFpc7fJt1

7/ Full disclosure: I've been friends with Steve, the CEO, since we went through YC together in 2005. And I'm a long time Reddit shareholder, because I’ve been a user since summer of ’05 and my rule is “buy stock in startups who make products you actually use".

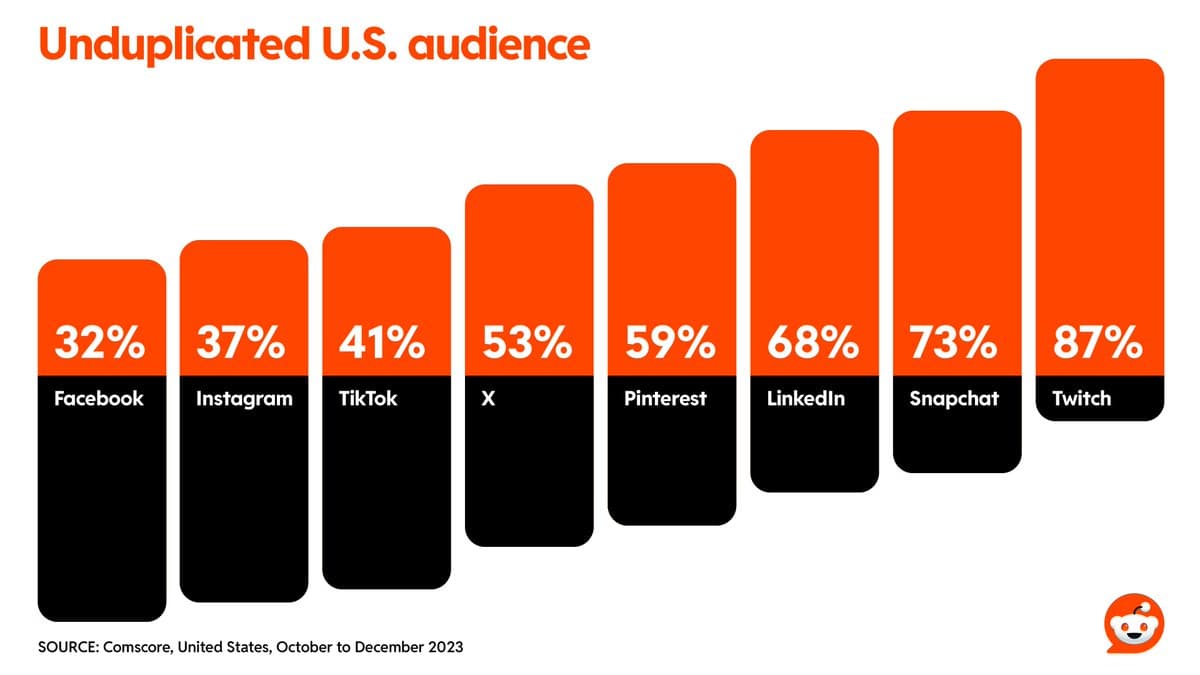

8/ Makes wonder tho…is it a coincidence that Steve and I both started social media platforms which share so many users with each other? Twitch and Reddit seem like they’re friends as services just like we are as people. https://t.co/1cYsFU9yIy

9/ One more quick note on the compensation -- over half the "$193m" appears to be in the form of options many of which are significantly underwater. Those have real value but only if Reddit appreciates a lot in value, otherwise they're worth zero. Which seems important.