🧵 View Thread

🧵 Thread (9 tweets)

We launched Stripe Capital today: https://t.co/go1GubWecs It offers extremely fast, data-driven access to working capital in advance, based on your business' activity on Stripe. This was my #1 ask of Stripe as a customer for 3 years running. I'm so happy we're rolling it out.

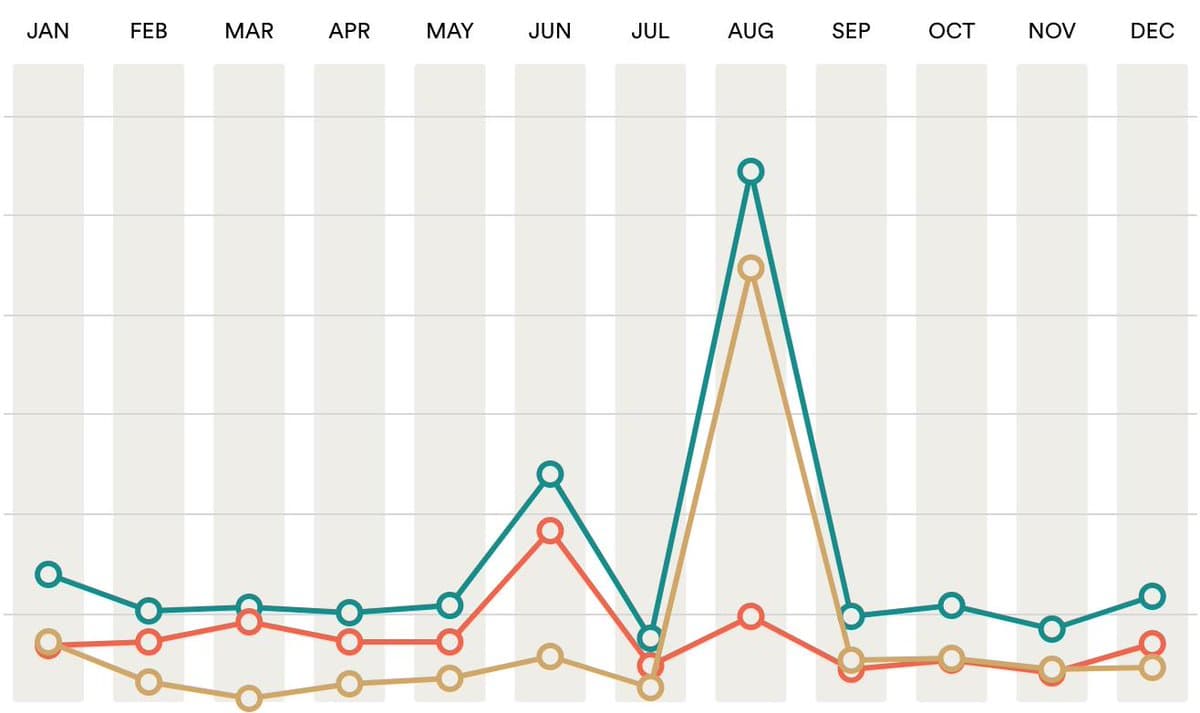

Why was this my #1 ask? Let me screengrab the cashflow report for a SaaS company I used to run from a year where I really wanted this. Green is revenue, red is expenses, gold is profit. This graph starts at 0; the business is profitable every month. https://t.co/L7fVrPCcFH

August was finally landing the payment for a large deal with a large enterprise. As you can imagine, that required a lot of pre-work. Pre-work costs current money. You would think a profitable software business with a contract in hand would get all the money from banks, right?

You would think that... if you've never gone through bank underwriting in the last 20 years. I visited, in person, eight banks in two countries. *Not one* was willing to loan money against either the existing extremely stable SaaS revenue stream or the upcoming work.

It wasn't an easy, "We just don't lend to small businesses" decline either. It was a "Hmm, interesting. Can we get together 50 pages of documentation from you, two years of taxes, a business plan, and a personal guarantee? Then we'll deny you 6 weeks from now."

I ended up paying the cash expenses (salaries, etc) for the pre-work with a combination of decreasing my own salary (and playing personal credit card games for 6 months), revolving balances on business cards, and getting a small line-of-credit from a non-bank lender.

This seems like a silly amount of work for a SaaS company, which by construction have EXTREMELY stable cash flows. They're so stable, in fact, that banks literally will not believe you when you explain how the math works. ("Oh you think revenue naturally recurs? That's cute kid")

So if you ever find yourself needing money to fund business expansion, and you'd like to get it from a company which can spell MRR and doesn't need to have a bespoke conversation with an underwriter because seriously why would we do that, check your dashboard.

As time goes to infinity it is extremely likely that we come up with other ways to get your businesses the money they need to achieve your goals for them. If there are particular form factors that interest you, please drop us a line.