🧵 View Thread

🧵 Thread (28 tweets)

Inflation is the source of most problems society faces today. Real costs decline, prices rise, but wages don't. This illusory phenomenon has disrupted all exchange, entrepreneurship, workers, savers, and borrowers; it's corrupted our lives and culture. 1/ https://t.co/aMWPkx5bkw

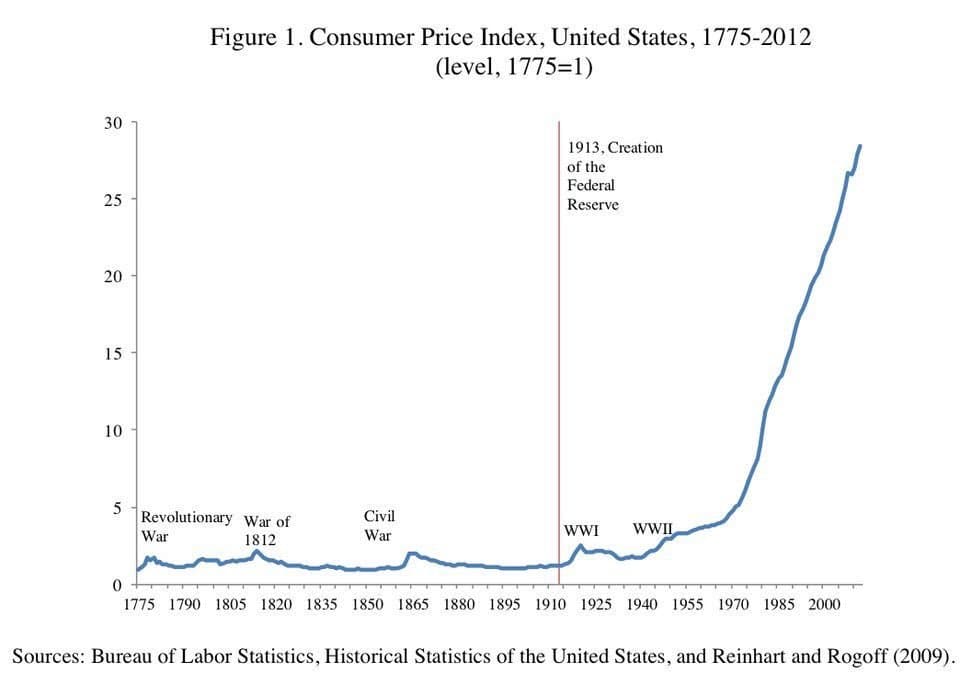

What is inflation anyway? In economics it is an increase in the supply of money, in colloquial terms it is a rise in prices; in practice, it is an inextricable link between these two issues understood simply as the law of supply and demand. 2/ https://t.co/MLkoFV5ZTv

While the supply of money is not the only factor that affects prices, it is the most important as it underlies all other factors, and usurps them all as the Fed nominally targets inflation absorbing and extracting all the gains we should see from real economic progress. 3/ https://t.co/PcLU8hhPCb

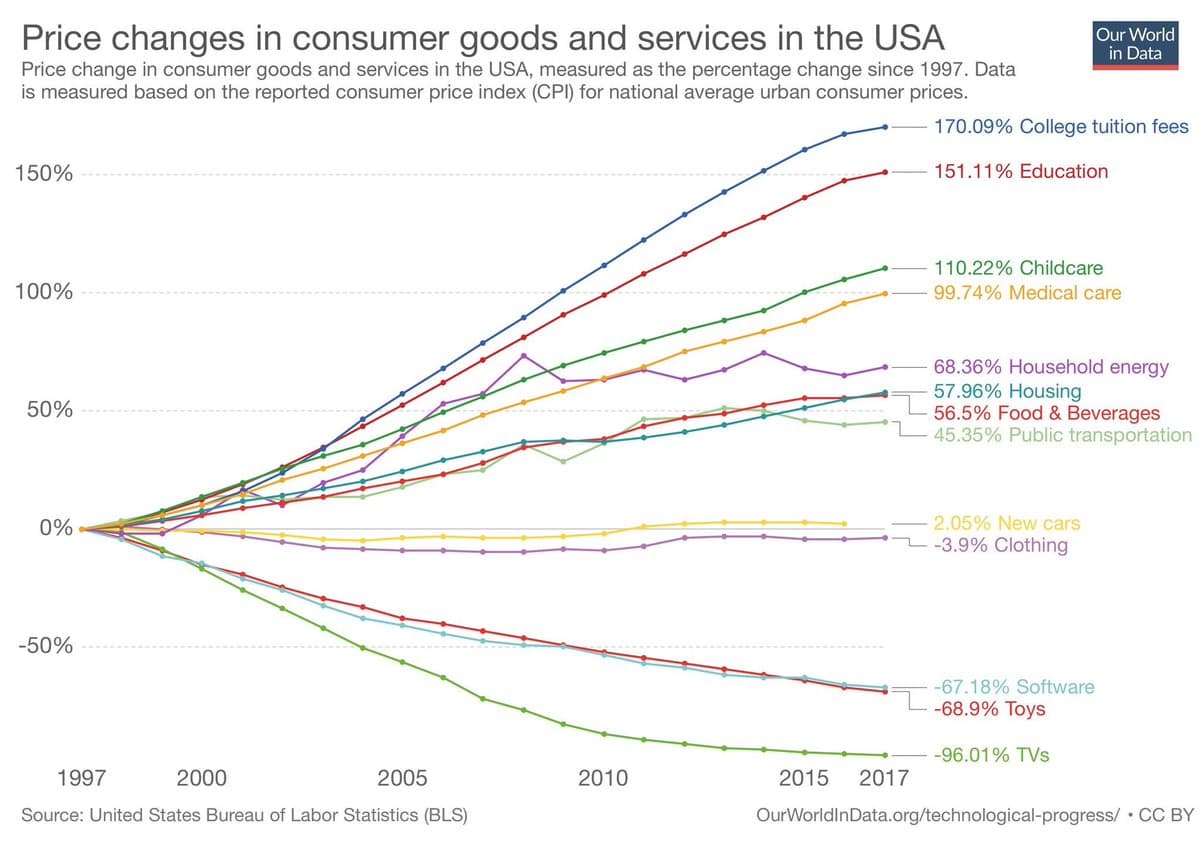

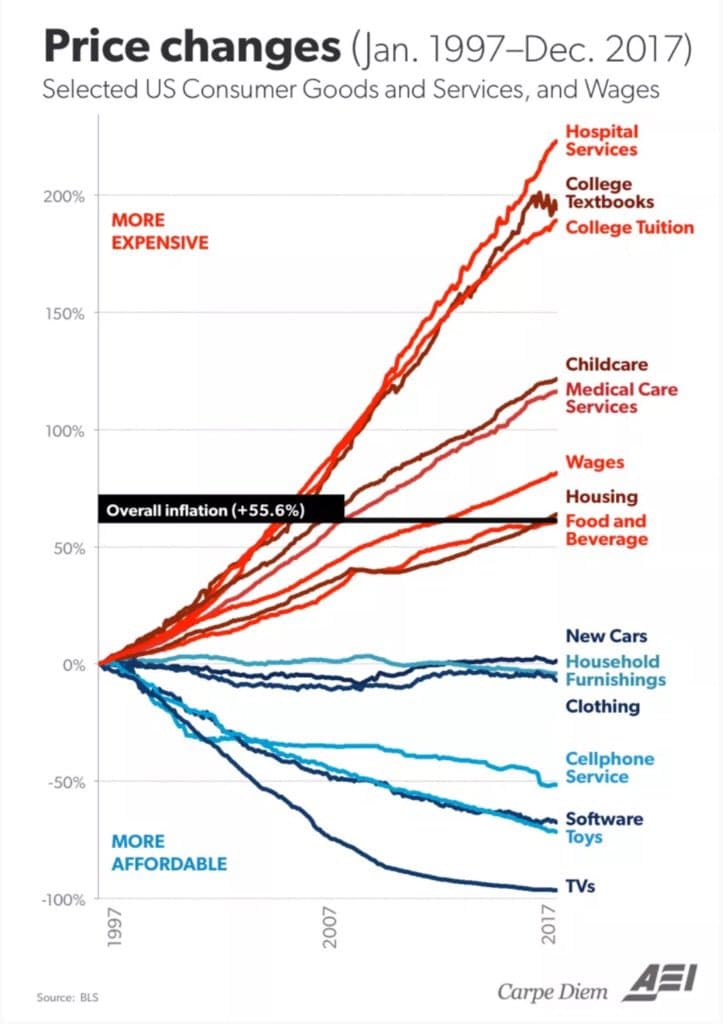

Deflation is good; we get better at producing cell phones and computers allowing us to buy more tech with the same money every year. Inflation is bad; rising costs of medical, housing, education, and food are the biggest issues we face: https://t.co/RIXwJt5aHf

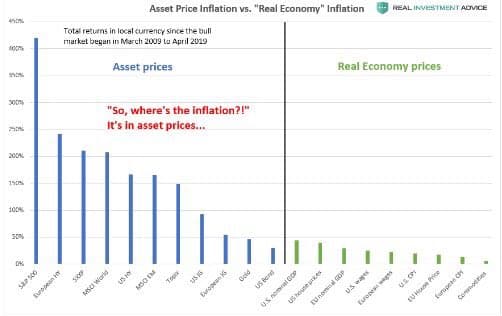

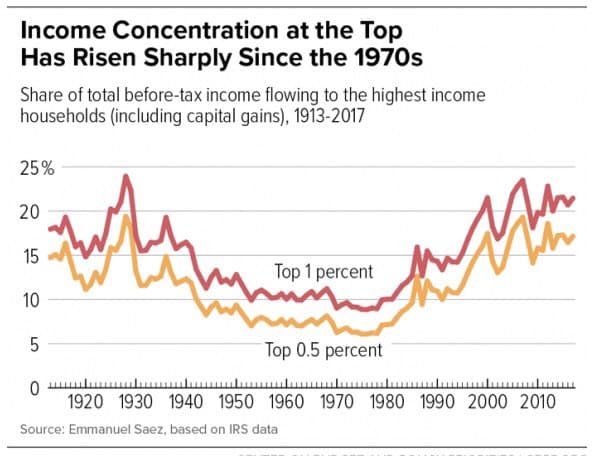

Why are these cost skyrocketing? Inflation (and government involvement). The increase in the supply of money must affect prices, supply/demand is an inescapable economic law. In the decade since 2008, inflation has largely gone to assets which inflates the wealth of the top 1% https://t.co/RIZe03UkUd

Why then are electronics deflationary? Because the rate of innovation and progress in this sector is so rapid it completely outpaces the phenomenon of inflation. We are enjoying some of the gains in productivity as a result. This is an essential component of economic progress.

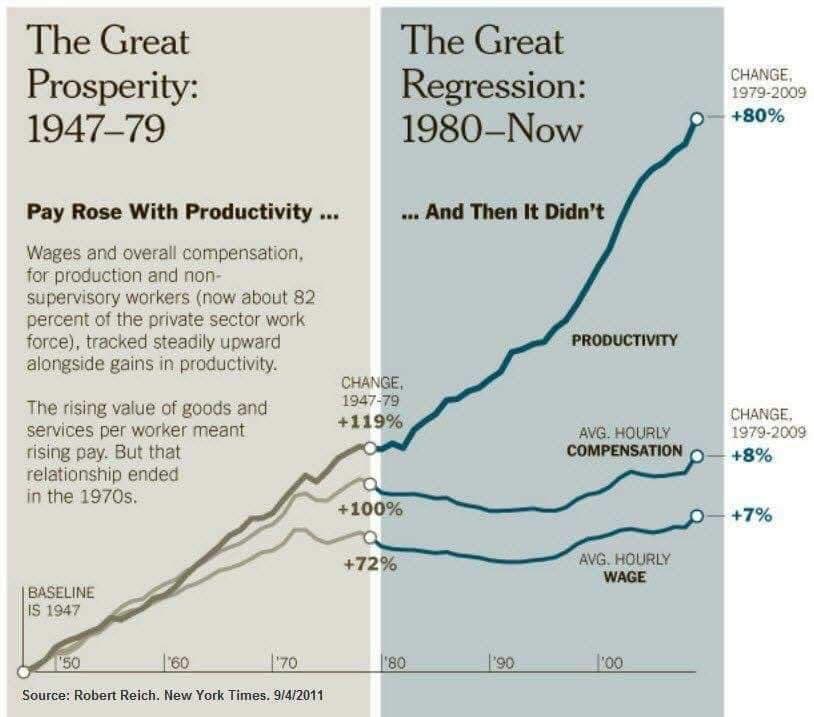

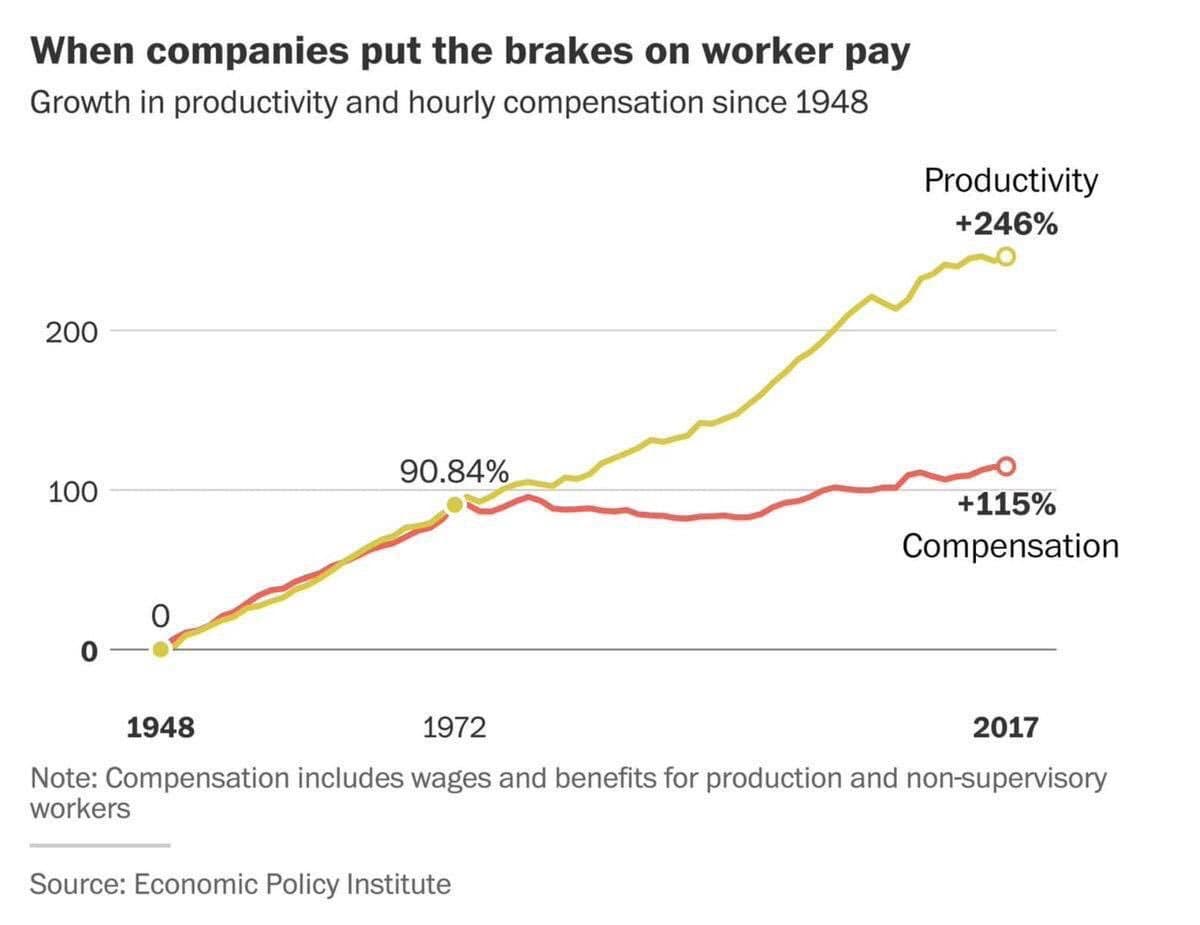

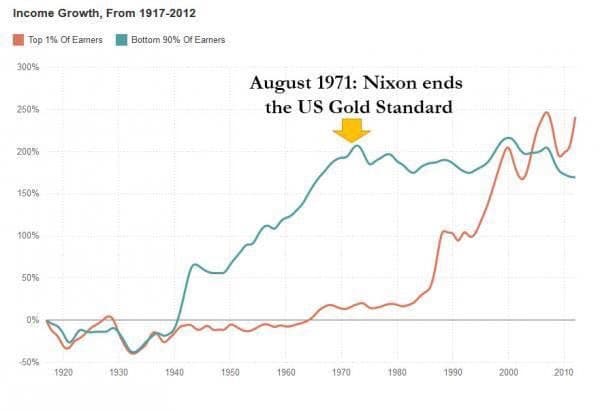

But that progress has been torn away from society as a whole. The gains from productivity have been decoupled from compensation exactly in the year 1971: https://t.co/koD4NwfiuS

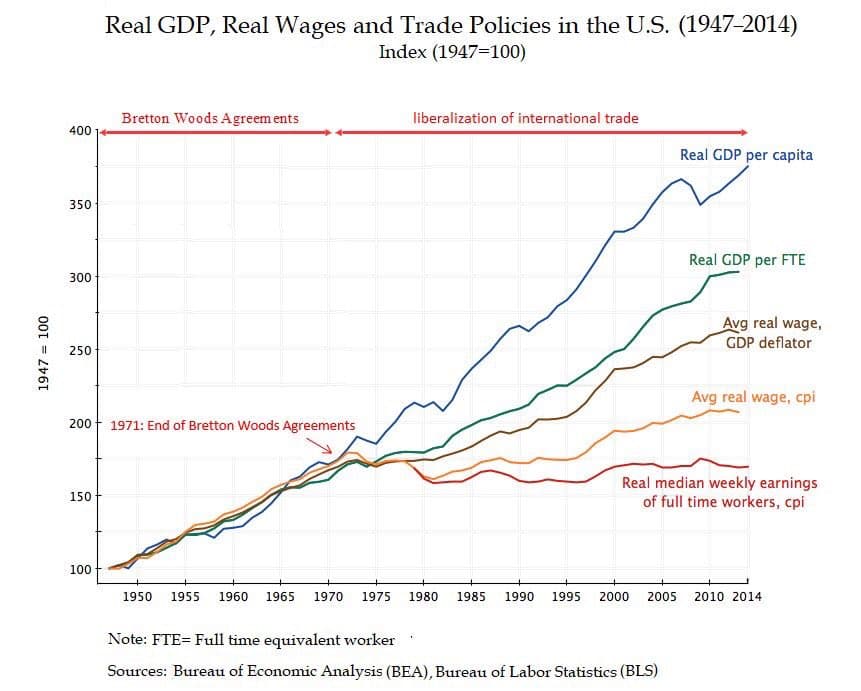

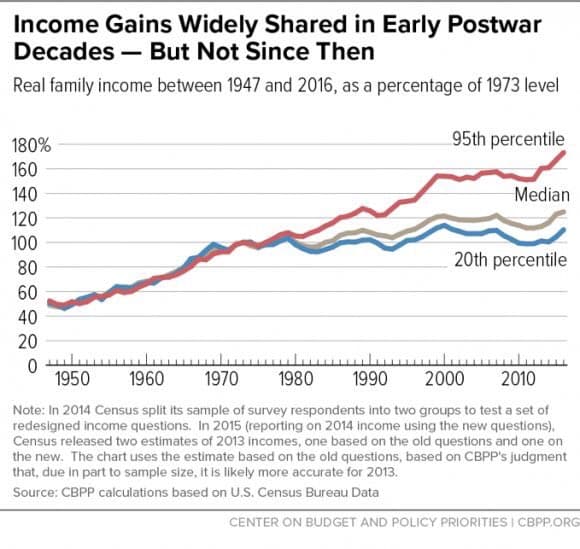

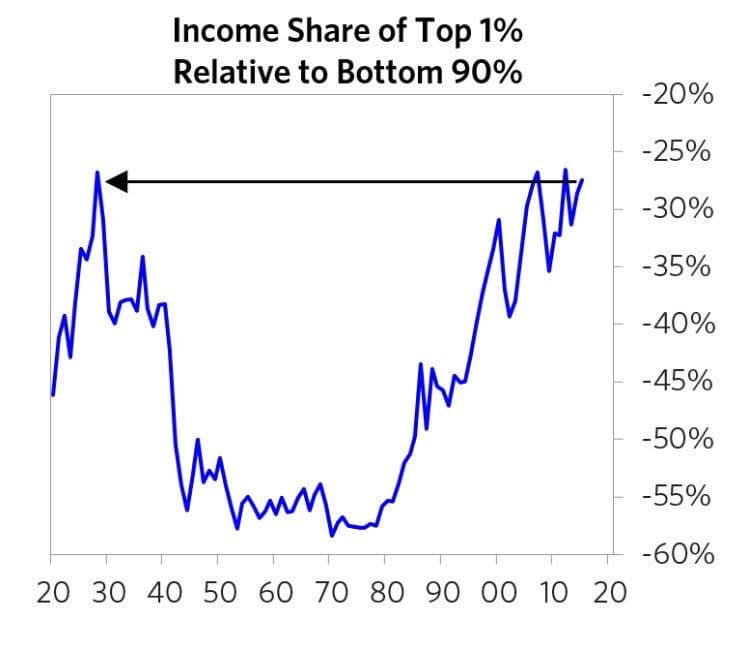

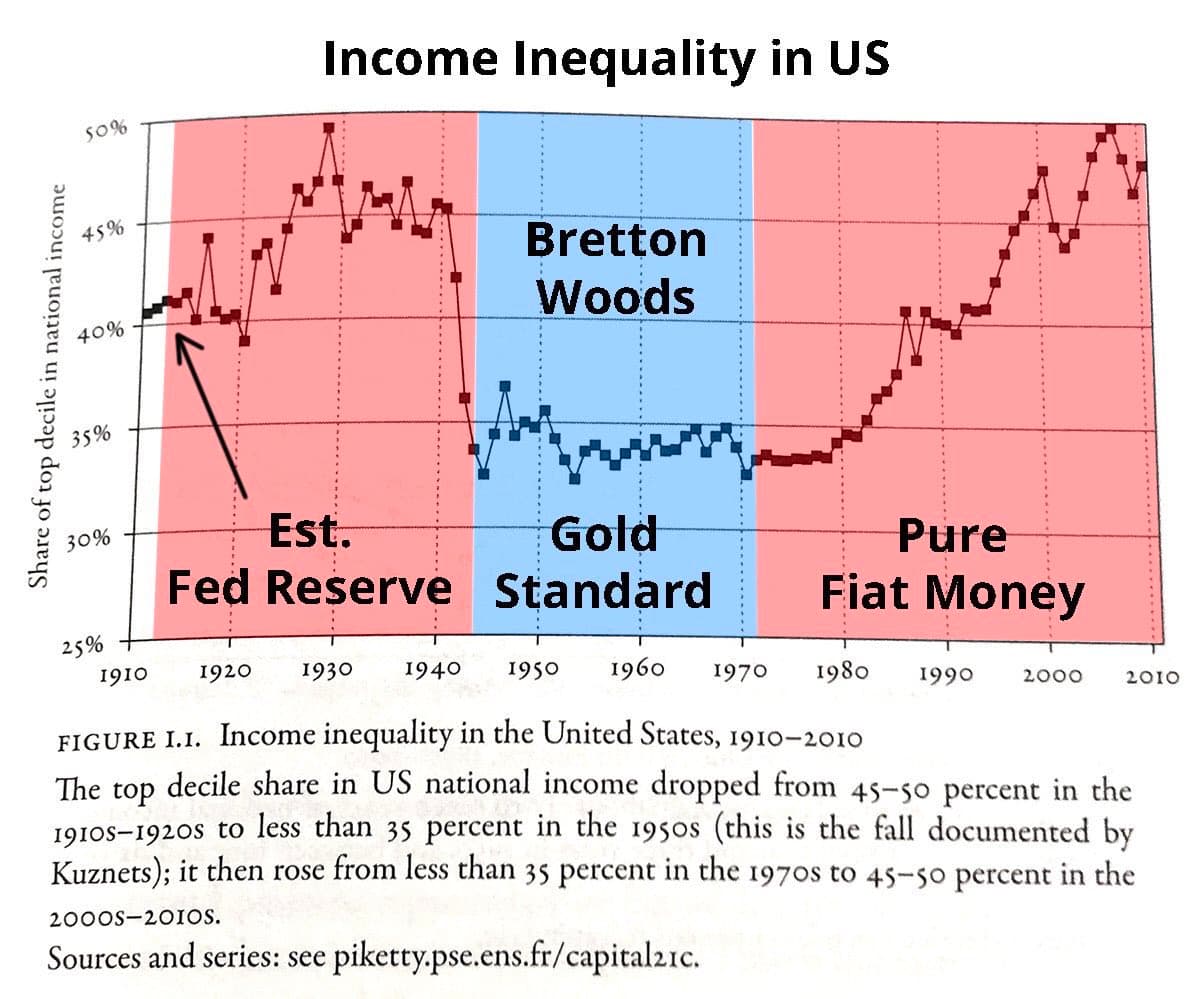

"What the hell happened in 1971??" It's quite clear that wealth inequality skyrocketed starting on infamous year. https://t.co/F1UHkGJl2P

1971 is the year we left the gold standard, abandoned sound money, and since we have seen the largest expansion of wealth inequality in history fueled by debt and inflation. https://t.co/2QhIBG8si2

We'll never return to a gold standard, and even if we did we'd always run the risk of going off again once people became complacent enough. Our only hope is some "sly roundabout way" of separating nations from controlling money. #Bitcoin is #SoundMoney https://t.co/XQ6Jr50bC6

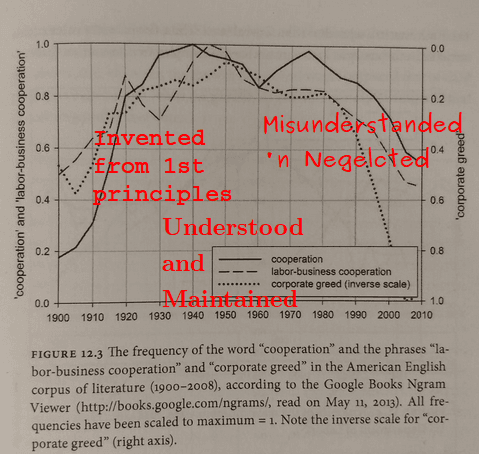

@mrcoolbp Inflation is bad and decent wages for workers are good :-) BUT see Turchin's "Ages of Discord: A Structural Analysis of American History". Ch12 applies Turchin's theory to reproduce the "What the hell happened in 1971?" graph almost perfectly without DIRECT use of inflation.

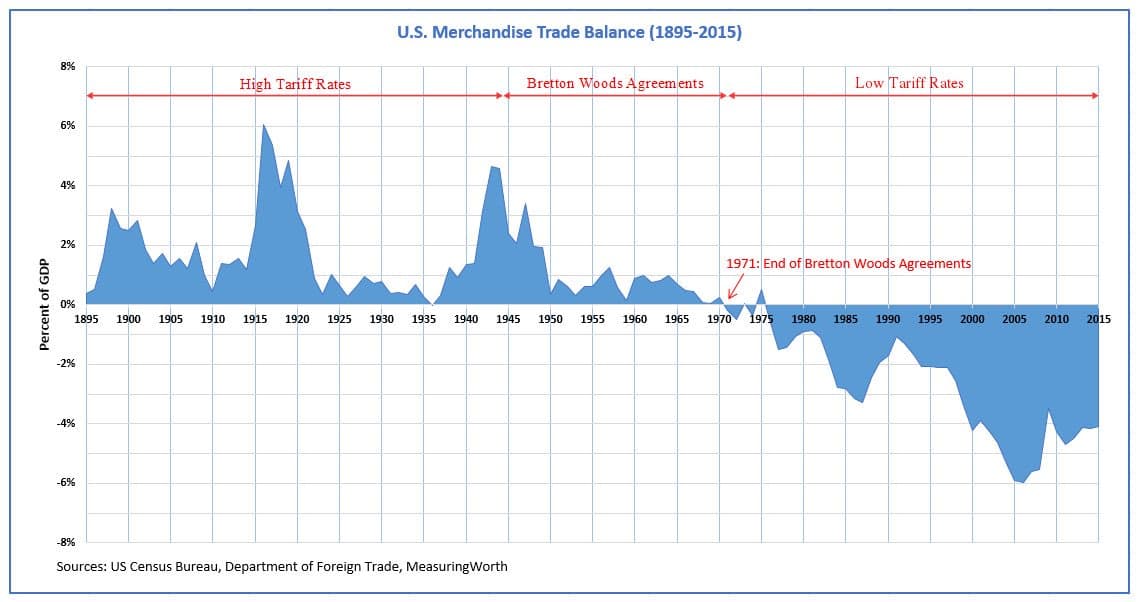

@mrcoolbp Directly: workers didn't get economic progress pass through after "supply" exceeded "demand". Ultimately: Turchin blames "elite" policies, which are blamed on elite DEMOGRAPHY. Relevantly: *He* mentions the Trade Balance (which *I* suspect is downstream of monetary policy). https://t.co/MdpB07SwIg

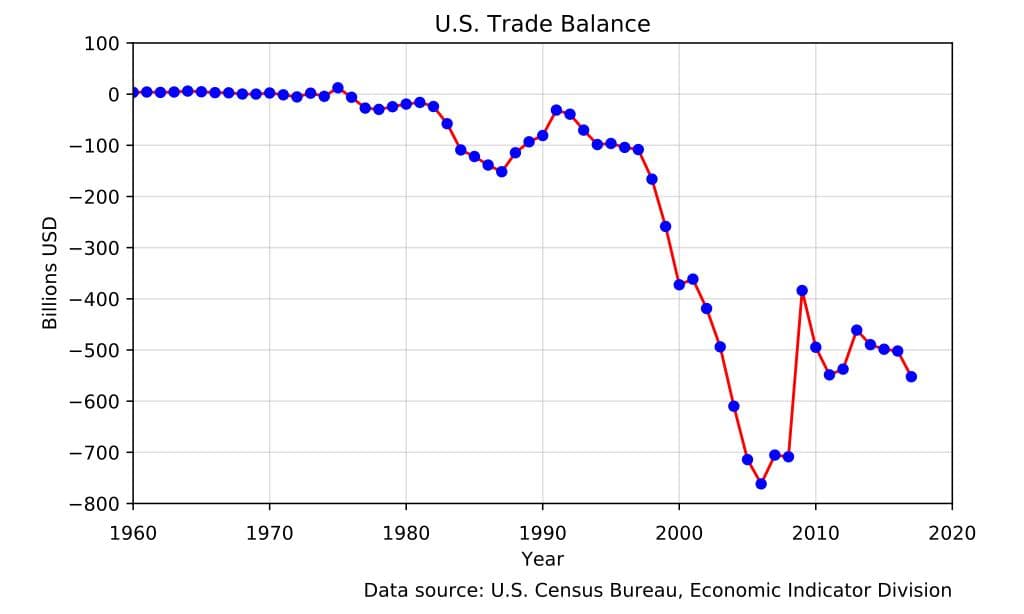

@almostlikethat So...it all comes back to the money. By the way check trade deficits, WTF happened in 1971!!?!! https://t.co/0It0oS2rXK

@mrcoolbp I'd agree "it all GOES THROUGH the money" but Turchin thinks it ALSO goes through elite culture. "Unsound money" may be a product of an elite culture that doesn't care about non-elites, but that culture is likely a "common cause" of many similar policies :-( https://t.co/vv4COe0OW3

@almostlikethat If only there was a way we could exit the broken system created by the elite culture... https://t.co/BLrB9Roy85

@mrcoolbp Exactly 👏 The real cost of inflation isn’t limited to the increase in the price of goods, as the inflation rate implies, but also the unknown and unrealized increases in efficiency. Not only should prices not rise, they should go down.